Tips For Saving Money As A Mom

Sponsored by Frost Bank

Saving money isn’t easy, especially when you have kids. It seems like there’s always something that comes up. We recently got the bill for Emma’s birth, and I was a bit in awe. Obviously I remember how much it was since it was my second time going through it, but dang it’s expensive to have kids, lol. It’s even worse when you’re self-employed, and your insurance isn’t the best.

Luckily we’ve been able to set aside some money for Noah and Emma when we opened up bank accounts with Frost Bank recently. We try to make a conscious effort to add money into their accounts each month.If you bank with Frost you will love their app. It’s so easy to use, and makes keeping track of their accounts really simple. Once they get older we can also easily add a checking account on top of their savings accounts. It can be really hard to save money as an entrepreneur, because you’re constantly investing money back into your business.

Life can throw you curve balls, and unexpected things happen making it even harder to save. Although it’s been really hard for us to save at times, I’ve stuck to some tips for saving money that have been helpful along the way. No matter how much money you’re making, you should try your best to save some (easier said than done, I know). I’m not trying to poise myself as a financial guru, because I’m totally not.

When Noah was born, we weren’t making much money at all. I was a contractor working for an affiliate marketing startup, and Dylan was launching a local business in Austin called the Austin Passbook. We were essentially living off of my contracting income which wasn’t much at all. We had to find ways to save money in whatever way we could. During those times when money was really tight, I found ways to be scrappy. Here are some things we did, and things that I still do today to save money.

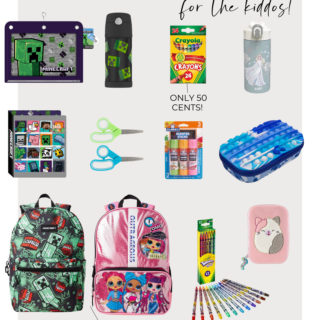

- We looked for coupons. I know this is a DUH, but you would be surprised at how much money you can save with coupons. We found coupons for diapers & groceries using various apps and websites. We shopped at HEB instead of Whole Foods and Central Market, and we stuck to the same recipes so we didn’t get too extravagant with our grocery bill. I’m not as good as using coupons now, but I do look for deals online anytime I’m buying something, and I always try to buy things when they are on sale instead of full price.

- We cut back on unnecessary expenditures. When you’re trying to save money things like manicures, pedicures, and getting your hair done go out the window. I have always been frugal about these things, and it’s saved me a lot of money. When you’re trying to save money, you just have to realize what’s really important, and getting your nails done just has to get scratched off of the list. You can easily do an at home manicure, and you can try a hairstyle that is low maintenance so you don’t have to book as many appointments throughout the year.

- We limited eating at restaurants. Restaurants can really take a toll on your bank account. Especially if you eat at them often. We try to cook as much as possible because we end up saving a lot of money that way. Plus, it’s much healthier to eat at home!

- We shared a car. I know this isn’t possible for every family, but it worked for us. Both of us worked from home so we shared a car instead of having two cars. It worked out for us because before we moved to Austin we almost moved to NYC so we had already sold a car preparing to move to a city where you don’t need a car. We ended up moving to Austin instead, but still just used one car for the longest time.

- We realized money doesn’t buy happiness. I know this isn’t exactly a tip about saving money, but it’s a tip that has been really important in my life. It’s something I want my kids to understand, and value. Money is something to be earned. Having it makes life easier, but it doesn’t always make life better.

What tips do you have for saving money? Would love for you to share them in the comments below! Thanks so much for stopping by today friends!

XO,

Lee Anne

A big thanks to Frost Bank for sponsoring this post. All thoughts & opinions are my own.

I love that you included sharing a car! We did this for a year to pay off debt and it was tough but so worth it!